Office vacancy falls as Alexandria bucks regional trend, but unemployment rises

City added or retained 4,100 jobs in 2025; council flags West End retail gap

Alexandria’s office vacancy rate fell to 18.9 percent at year’s end — bucking a regional trend that has seen Northern Virginia’s vacancy rise to 21 percent — but local unemployment has ticked up as federal job cuts continue to ripple through the economy.

The data came on Tuesday night during the Alexandria Economic Development Partnership’s year-end market report to the City Council, presented by AEDP Vice President of Real Estate Christina Mindrup. The report landed as the city prepares to enter budget season, with City Manager James Parajon’s proposed FY 2027 budget scheduled for Feb. 24.

“Our retail market is strong. Over 4,000 new jobs have been either retained or recruited in a single year period,” Parajon said. “I think those are really positive signs. We still have to watch the uncertainty in some of the office markets.”

Office vacancy down, but not everywhere

The citywide office vacancy rate dropped from 21.1 percent in 2024 to 18.9 percent — a 2.2-point improvement driven largely by office-to-residential conversions removing obsolete space from the market.

The removal of 5001 Eisenhower Avenue from the office inventory — after more than 20 years vacant — was a major factor. “Region-wide, folks are celebrating the removal of Victory Center,” said Christina Mindrup, vice president of real estate for the Alexandria Economic Development Partnership.

But vacancy rates vary widely by submarket:

Potomac Yard: 0 percent — signaling a need for new office construction

Old Town: 14.8 percent, up slightly from 14.3 percent

West End: 19.8 percent, up from 18.6 percent

Carlyle: 27.7 percent, down from 29.1 percent

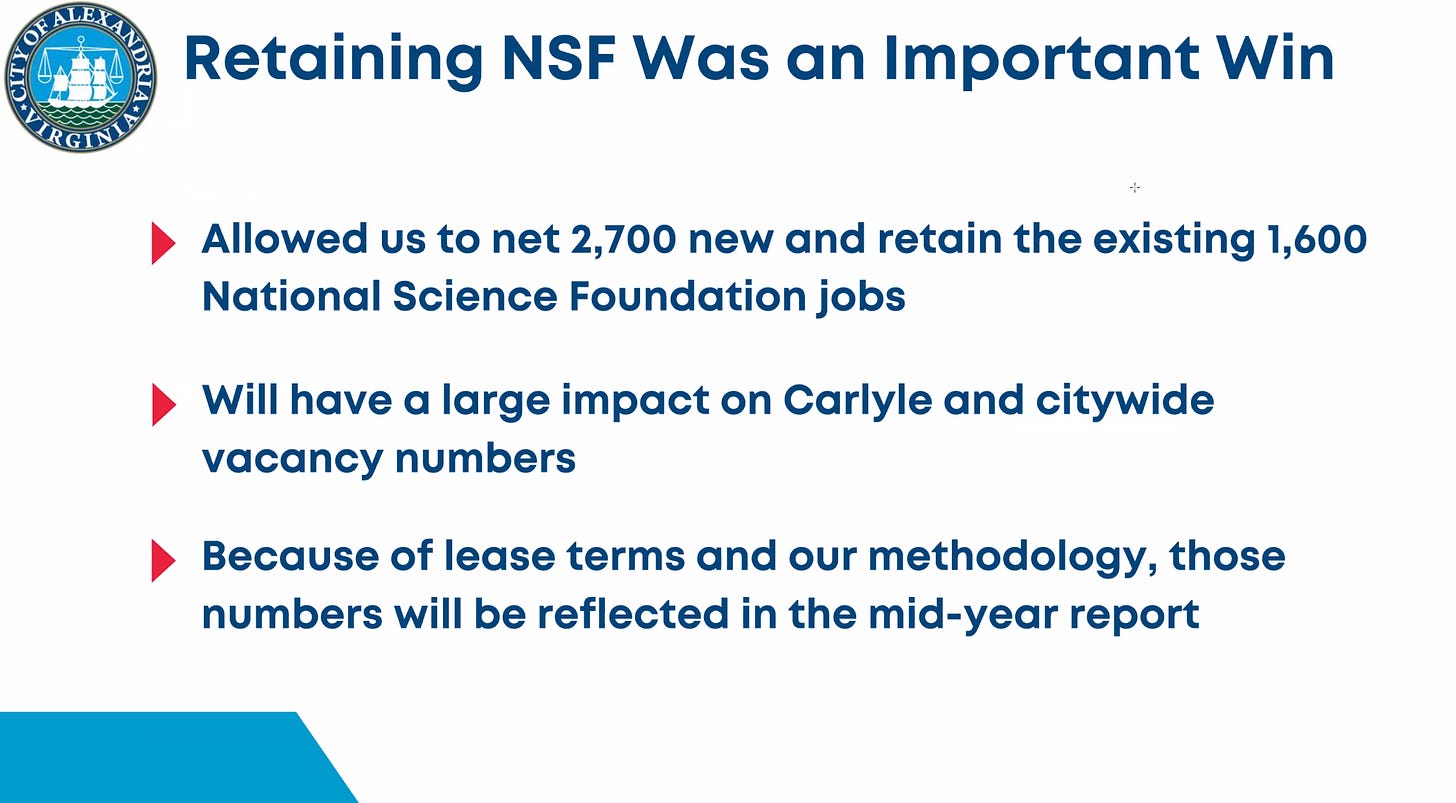

The Carlyle numbers are expected to improve significantly when the National Science Foundation’s lease is reflected in the next report. NSF announced in December it would remain in Alexandria, occupying 386,000 square feet in a former Patent and Trademark Office building. That absorption alone could reduce citywide vacancy by 2.5 percent and Carlyle vacancy by 6 percent.

Alexandria’s neighbors are faring worse. Arlington County is reporting 23.8 percent vacancy; Fairfax County is at 23 percent.

Jobs added, but unemployment rising

The city added or retained 4,106 jobs in 2025 — about 4 percent of Alexandria’s total job base — through economic development efforts. Major wins included:

HUD headquarters relocation: 2,700 new jobs, currently underway

National Science Foundation retention: 1,600 jobs retained, plus future growth

Systems Planning & Analysis: 600 jobs retained, 500 new jobs over five years

But unemployment rose to 3.8 percent, up from 3.4 percent in May — “largely due to the ripple effect of the government shutdown and job cuts,” Mindrup said.

Alexandria is still outperforming the region, which posted 4.5 percent unemployment in November.

West End retail gap flagged

Retail vacancy remains healthy at 4.6 percent, with 72 retail and restaurant openings announced in 2025 — about half independently owned and half national tenants.

But Councilman John Chapman noted a geographic imbalance: most new retail activity is concentrated along the “crescent curve” from Old Town through Potomac Yard, with little action in the West End.

“I think that signaled kind of almost a red flag to me,” Chapman said. “We still have a majority of our community that lives in those sections of town. Figuring out how we add or try to plan additional activity to be out where the people are might be helpful.”

Mayor Alyia Gaskins echoed the concern, noting that West End businesses have reached out asking about retention strategies.

“How do we keep them here, and what does that look like?” Gaskins said. “How can we be intentional, especially in areas where we’re not seeing as much new activity?”

Councilwoman Jacinta Greene asked whether the city tracks business closures. Mindrup said AEDP does not have a systematic way to track closures unless they learn about them through press releases or direct relationships.

“It’s much easier to track the openings than the closings,” Mindrup said, adding that she would meet with staff this week to discuss retail retention strategies for the West End.

Conversions driving stability

Gaskins asked staff to identify which office buildings should remain office space versus which could be converted to housing — acknowledging that conversions have stabilized the market but that the city still needs some commercial base.

“Not every building can be converted, and there are probably some buildings we don’t want to convert,” Gaskins said. “It would be helpful to get some sort of map or understanding of where those nodes are where we want to keep office.”

The development pipeline remains heavily residential. Sixteen projects were entitled last year — consistent with prior years — with roughly 4,000 units approved over the past two years, including 411 affordable units.

Budget season ahead

The report sets the stage for a budget season shaped by federal uncertainty. Last month, Parajon reported national federal employment had dropped 277,000 positions — 9 percent — since January 2025.

The FY 2027 budget calendar begins Feb. 24 with the City Manager’s proposed budget presentation. Work sessions and public hearings continue through the spring, with final adoption scheduled for April 29.