What does 'affordable housing' actually mean? A guide to Alexandria's housing categories and income levels

As city pursues plan to preserve thousands of affordable units, understanding definitions and income thresholds is crucial to grasping who would benefit

When Alexandria officials talk about preserving “market-affordable” housing versus “committed affordable” housing, or serving residents at “60% AMI,” what do those terms actually mean? And why does it matter?

As the city pursues an ambitious plan to preserve thousands of affordable units, understanding the definitions and income thresholds is crucial to grasping who would benefit — and what’s actually at stake.

Here’s a guide to the key terms and numbers shaping Alexandria’s affordable housing debate.

The two types of affordable housing

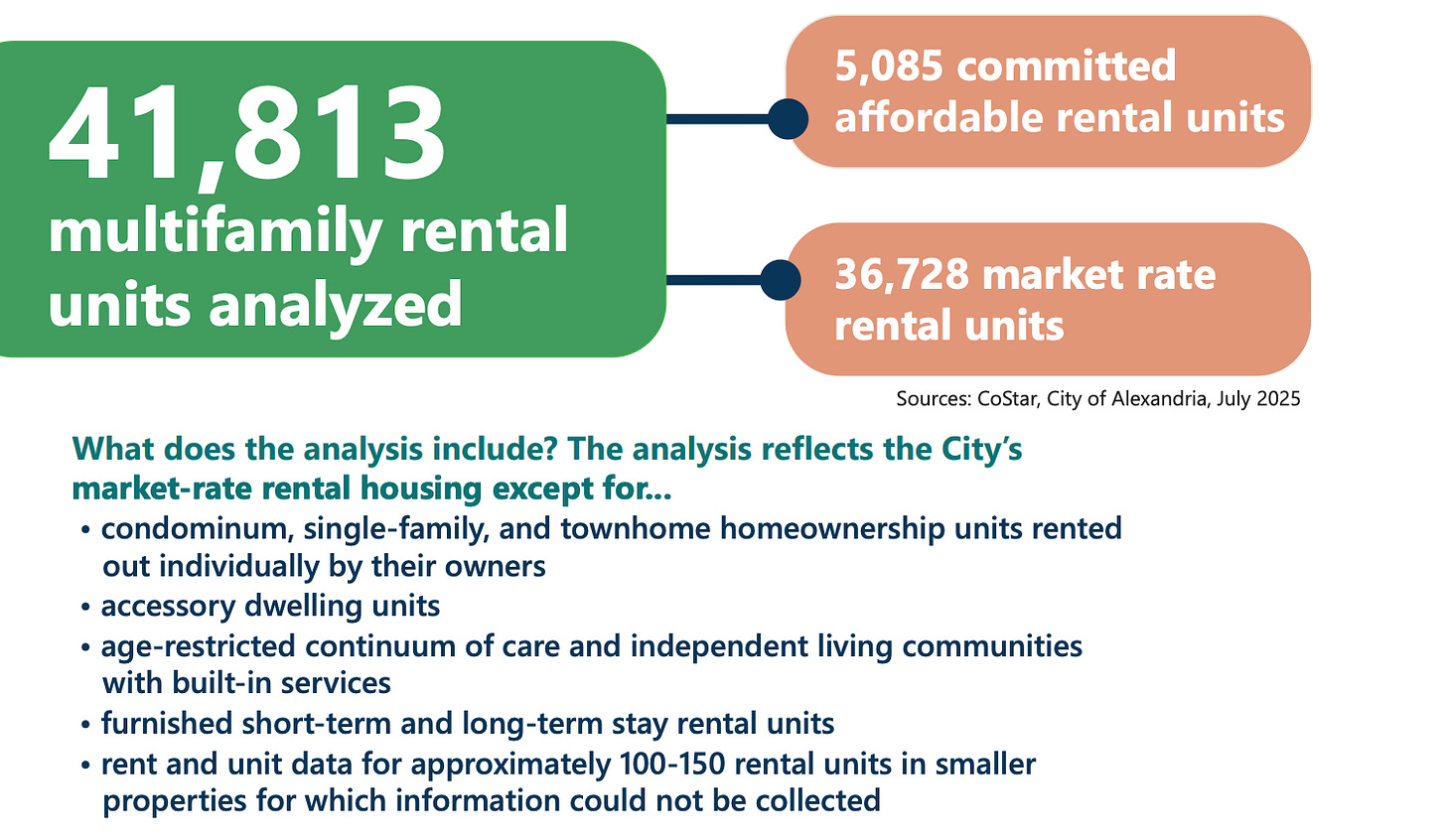

Alexandria tracks approximately 25% of its 41,813 multifamily rental units as affordable housing. But not all affordable housing is the same.

Market-affordable housing: ~7,000 units

According to the city’s official definition, market-affordable units are “non-subsidized rental units affordable to households earning 60% AMI. Rents at these units are not restricted and may cease to be affordable at any time.”

These are apartments that are naturally affordable to low- and moderate-income residents without any government subsidies or rent restrictions. A $1,700-per-month one-bedroom in an older building where the landlord simply hasn’t raised rents to match newer luxury apartments charging $2,500.

The crisis: In 2010, Alexandria had an estimated 12,000 market-affordable units, including approximately 3,000 at 40% AMI. By 2025: approximately 7,000 — a loss of 5,000 units, or 42%, in just 15 years.

“The loss of market affordability since 2010 is generally attributed to rising housing costs as opposed to demolition and redevelopment,” according to the city’s 2025 rental market analysis.

Why they’re disappearing: Buildings get renovated and rents increase; rising operating costs force rent hikes; properties sell to new owners who raise rents; natural turnover leads to market-rate pricing.

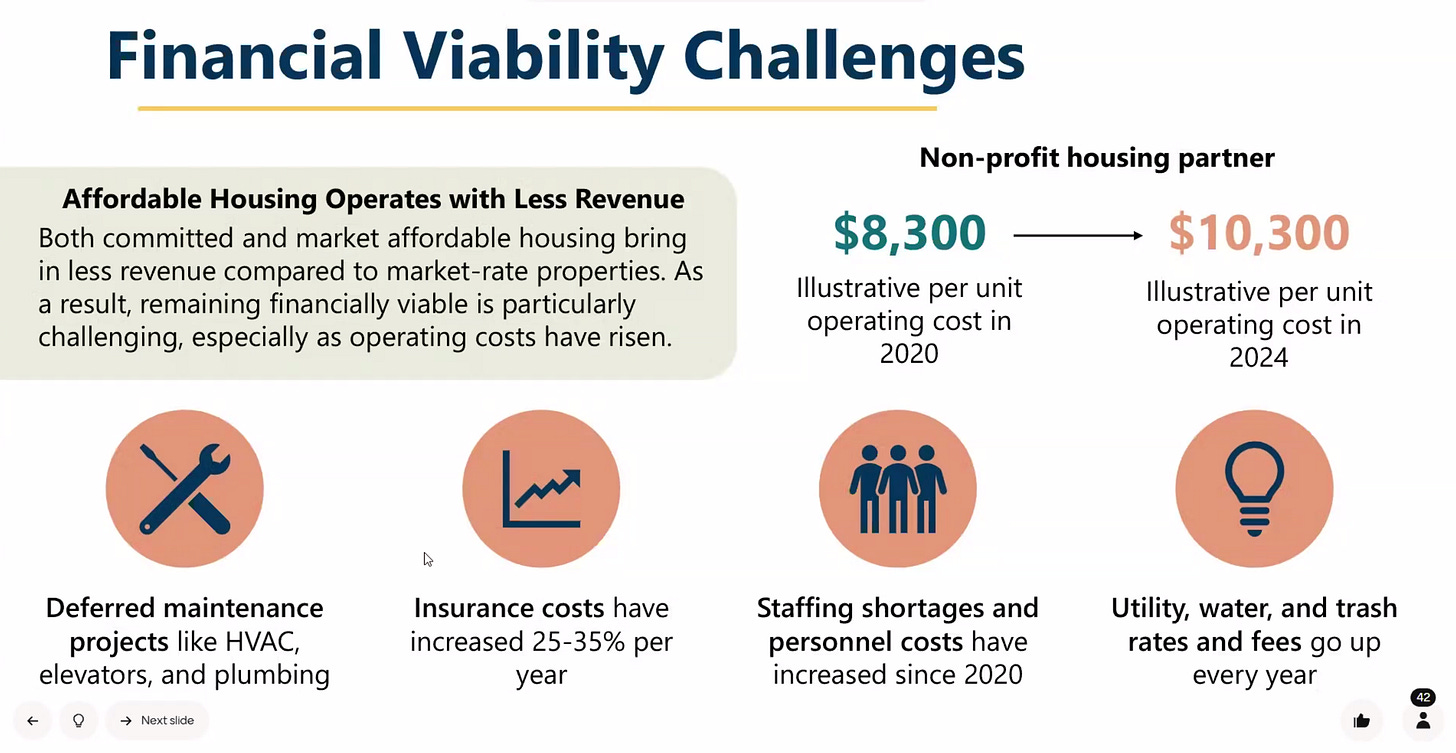

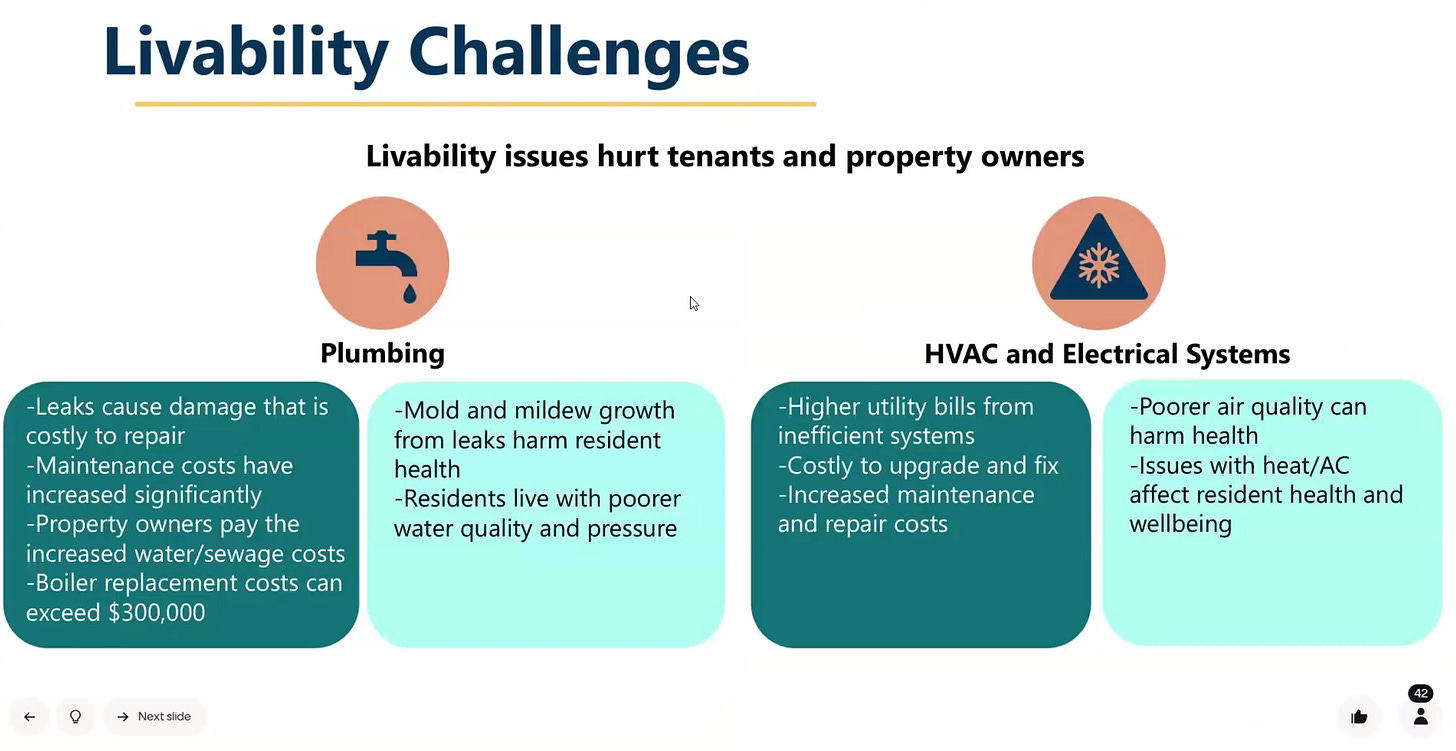

Christopher Do, a city housing analyst, explained the financial pressure: “Boiler replacement costs end up costing about $300,000. And that might have gone up since we got that estimate.”

Committed affordable housing: 5,085 units

These apartments have legal restrictions requiring them to stay affordable for a specific period—typically 30 years for Low-Income Housing Tax Credit properties, or 20 years for Project-Based Voucher contracts. Landlords receive subsidies or tax benefits in exchange.

The crisis: More than 900 committed affordable units face expiring commitments by 2040. “By 2040, we have identified about 900 committed affordable units that are at risk of expiration,” Do said.

Types include Low-Income Housing Tax Credit properties, Project-Based Vouchers, public housing operated by ARHA, city-funded affordable units with deed restrictions, and inclusionary zoning units.

The city is proposing updated terminology in Housing 2040: units serving up to 80% AMI would be “committed affordable,” with a new “priority committed affordable” category for units serving households up to 50% AMI.

Understanding Area Median Income (AMI)

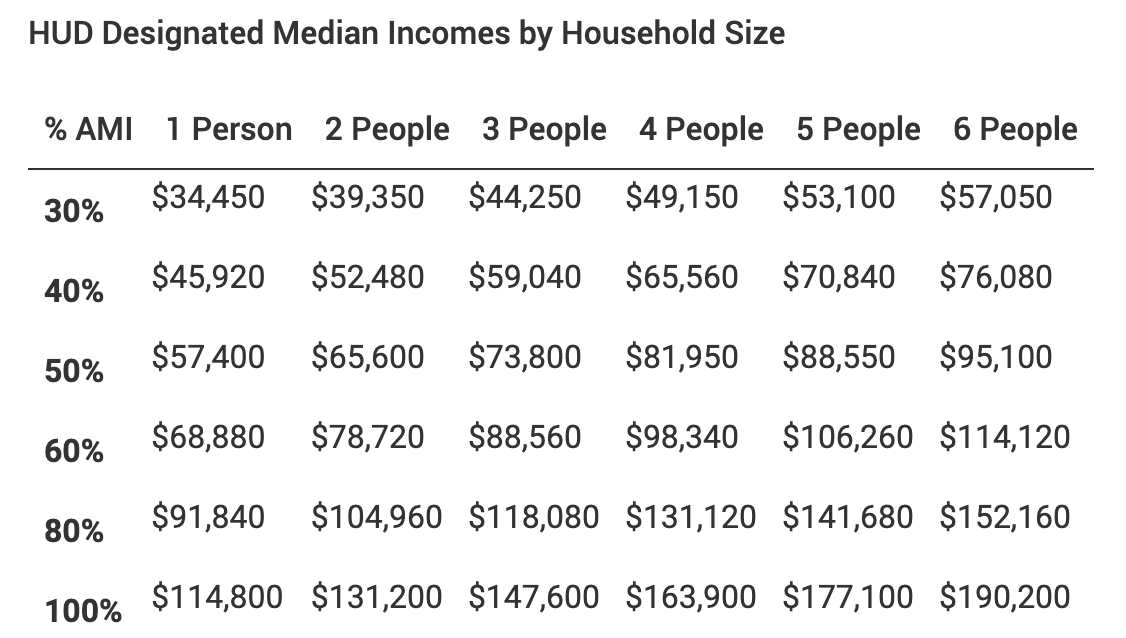

AMI is the midpoint of incomes in the Washington-Arlington-Alexandria metro area—half of households earn more, half earn less. According to HUD, the 2025 AMI for a household of four is $163,900—among the highest in the nation.

When officials say ‘60% AMI,’ they mean households earning 60% of these levels—think teacher aides ($68,880/year for one person), retail workers, and paralegals. At 50% AMI, you’re looking at childcare workers and food service employees ($57,400). At 80% AMI: teachers, nurses, and firefighters ($91,840)

The affordability gap

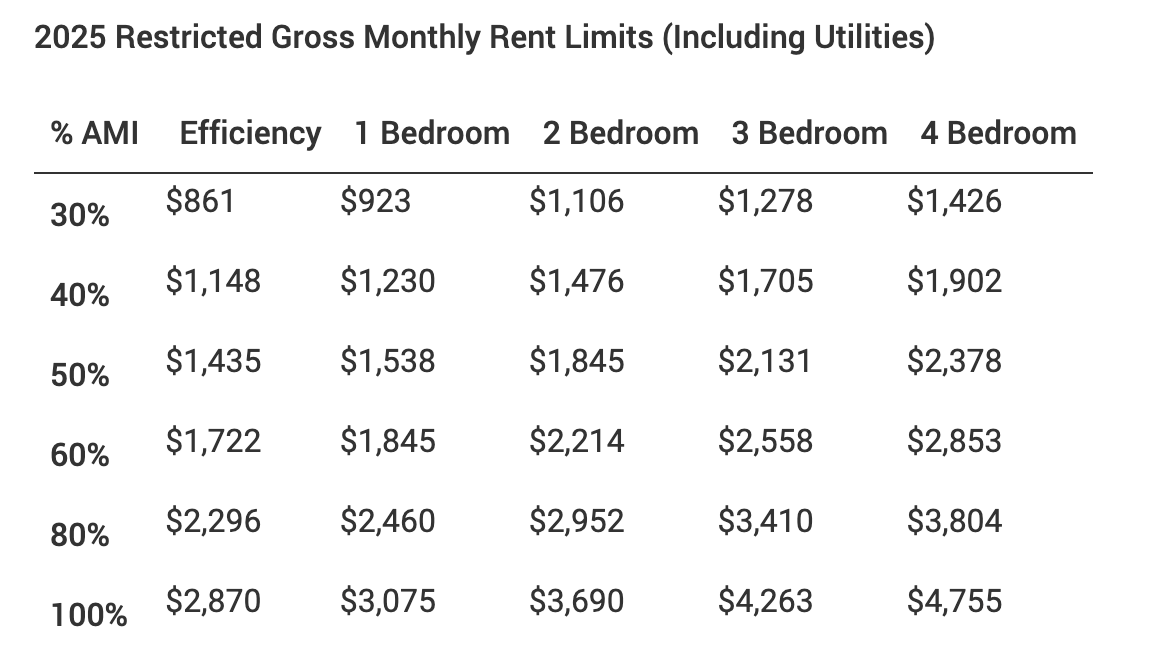

Housing is “affordable” if it costs no more than 30% of household income. The city publishes official rent limits for committed affordable housing based on this standard.

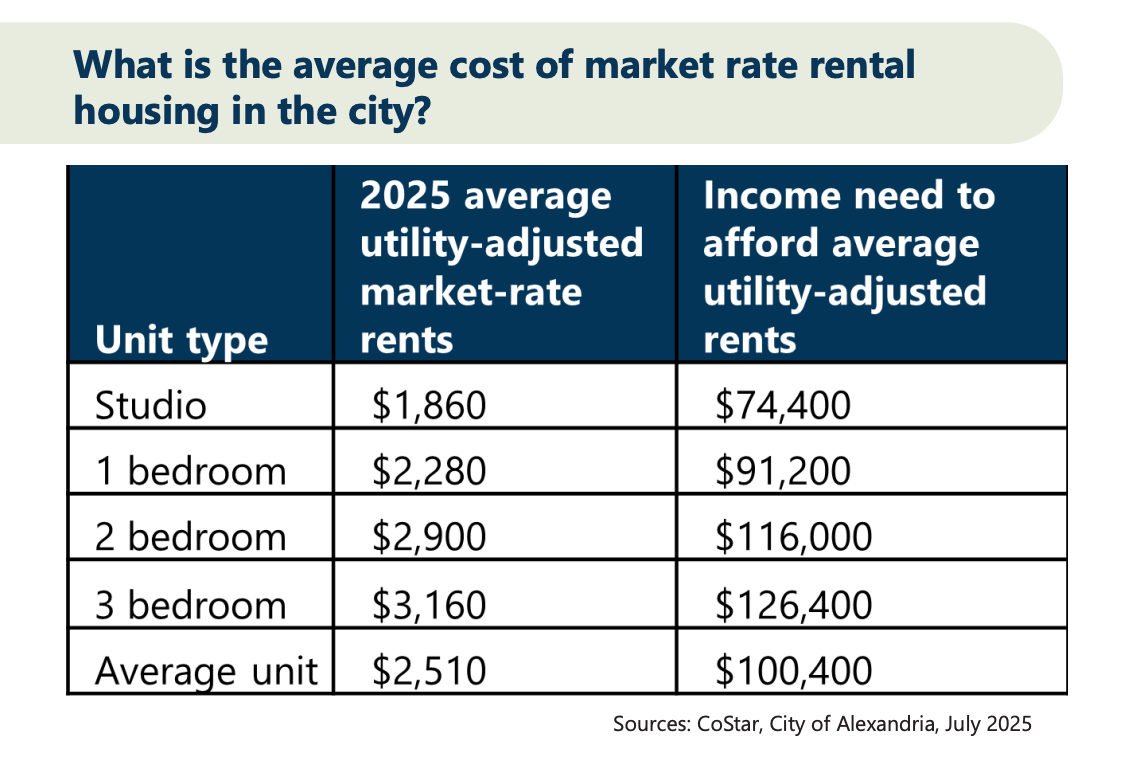

But what does rent actually cost?

The gap: A household earning 60% AMI can afford $1,845 for a one-bedroom. The average costs $2,280—a $435 monthly gap, or $5,220 per year. That household would be paying 48% of income on housing, far above the 30% threshold.

Without subsidized affordable housing, low- and moderate-income households face impossible choices: pay more than they can afford, move far from jobs and services, or double up in overcrowded conditions.

What types of units are available?

Approximately 60% of market-rate rental units are one-bedroom or smaller—a mix that doesn’t always serve families.

The city’s analysis found that of 36,728 market-rate units:

Only 2% are naturally affordable to households below 60% AMI

44% require incomes above 120% AMI

This distribution shows why preservation of the few remaining market-affordable units is critical.

The aging housing crisis

The median multifamily rental building in Alexandria was constructed in 1966—making it 59 years old. Approximately 20,750 rental units—nearly half the city’s stock—were built before 1984.

These older buildings face mounting challenges: aging plumbing and electrical systems, outdated HVAC, deferred maintenance, energy inefficiency, and structural issues. “Mold and mildew develop from these leaks for plumbing issues,” Do explained. “And then residents have to live with the effects on their health.”

The rehabilitation creates a vicious cycle: Owners face enormous repair costs but can’t raise rents enough to cover them while keeping units affordable. Many choose to defer maintenance (leading to deteriorating conditions) or raise rents to market rate.

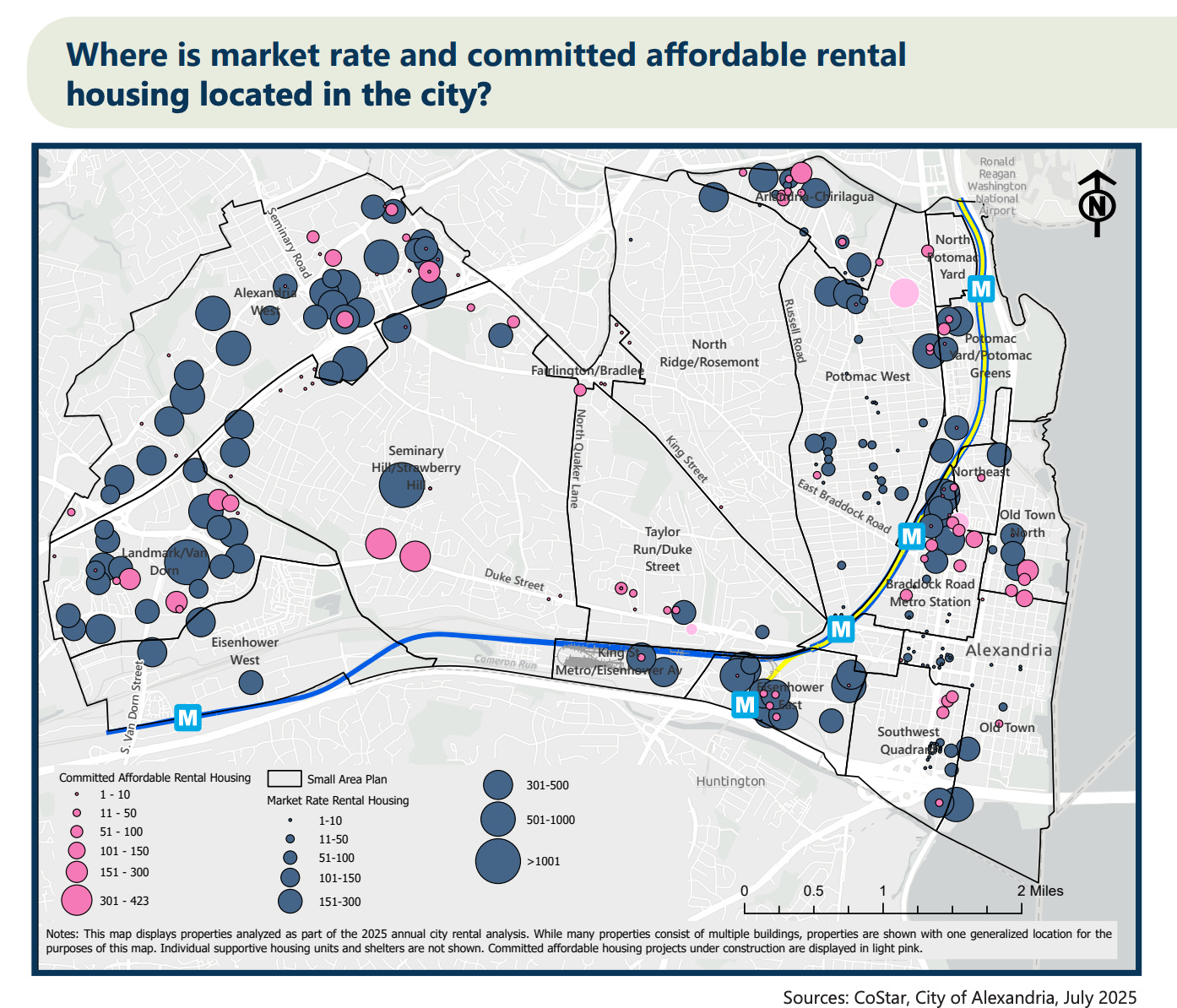

Where is affordable housing located?

Neighborhoods with significant concentrations include Arlandria-Chirilagua, Seminary Hill/West End, the Eisenhower corridor, North Old Town, Potomac Yard, and the Landmark/Van Dorn area. Older garden-style complexes from the 1960s-80s make up much of the market-affordable stock.

The city’s preservation track record

Since 2013, Alexandria has acquired or preserved 660 units, extended affordability for 152 units, replaced 249 units while creating 413 net new units through redevelopment, and rehabilitated 888 units.

Why definitions matter for the preservation plan

Different types of affordable housing require different preservation strategies.

For market-affordable housing (approximately 7,000 units): No legal protections exist. The city must acquire properties or convince owners to accept voluntary restrictions. Main strategies include acquisition before properties sell to market-rate developers, rehabilitation assistance in exchange for affordability commitments, and property tax incentives.

For committed affordable housing (5,085 units): Legal restrictions already exist but are expiring. The city can work with owners to extend commitments, though subsidies may be needed to make extensions financially viable. Right of First Refusal allows city or nonprofits to purchase if owners won’t extend. This pathway is more straightforward since an affordability framework exists.

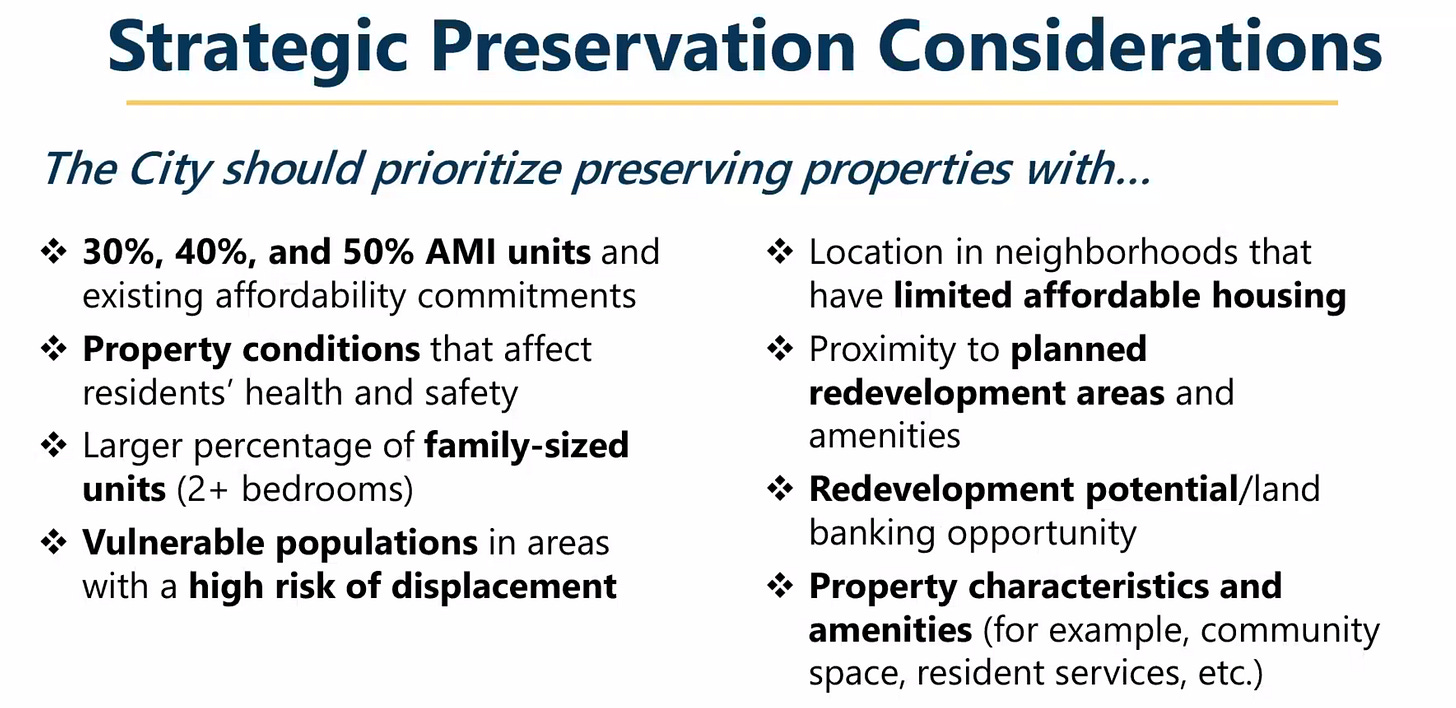

Strategic preservation priorities

The city has proposed criteria for prioritizing limited preservation resources:

Properties should be prioritized based on: depth of affordability (30-50% AMI gets priority); health and safety conditions; family-sized units; vulnerable populations in high-displacement-risk areas; neighborhoods with limited affordable housing; proximity to transit and amenities; redevelopment potential; and existing community services.

These criteria aim to maximize impact by focusing on the most vulnerable residents and most at-risk properties.

What happens when affordable housing disappears?

When market-affordable units are lost, residents must pay more than they can afford, move far from jobs and services, or live in overcrowded conditions. Children change schools mid-year. Workers face longer commutes or leave jobs. Elderly residents lose community connections. Economic diversity decreases. Essential workers—teachers, nurses, firefighters, retail employees, childcare workers—live outside the community they serve.

When committed affordable commitments expire, property owners can convert to market-rate. Existing tenants face displacement through rent increases. No new low-income families can move in. Waiting lists for remaining affordable housing grow longer.

This dual crisis—market-affordable disappearing and committed affordable expiring—is why Monday’s preservation plan addresses both simultaneously.

Key housing terms

Affordable housing: Rental or ownership housing costing no more than 30% of household gross monthly income.

AMI (Area Median Income): Income benchmark where half of regional households earn more, half earn less.

Committed Affordable Unit (CAU): Housing with rent/occupancy restrictions imposed as a condition of federal, state, or local program assistance.

Cost-burdened: Spending more than 30% of income on housing. “Severely cost-burdened” means more than 50%.

LIHTC (Low-Income Housing Tax Credit): Primary source of affordable housing funding nationally. Created in 1986, typically with 30-year affordability requirements.

Market-affordable: Non-subsidized units affordable to 60% AMI households. No rent restrictions; may cease to be affordable anytime.

PBV (Project-Based Voucher): Federal vouchers tied to specific properties rather than tenants. Typically 20-year terms.

ROFR (Right of First Refusal): Agreement giving city or nonprofit the right to match any purchase offer before property sells.

Dillon Rule: Virginia legal principle limiting local governments to only powers expressly granted by state legislature.

Next steps

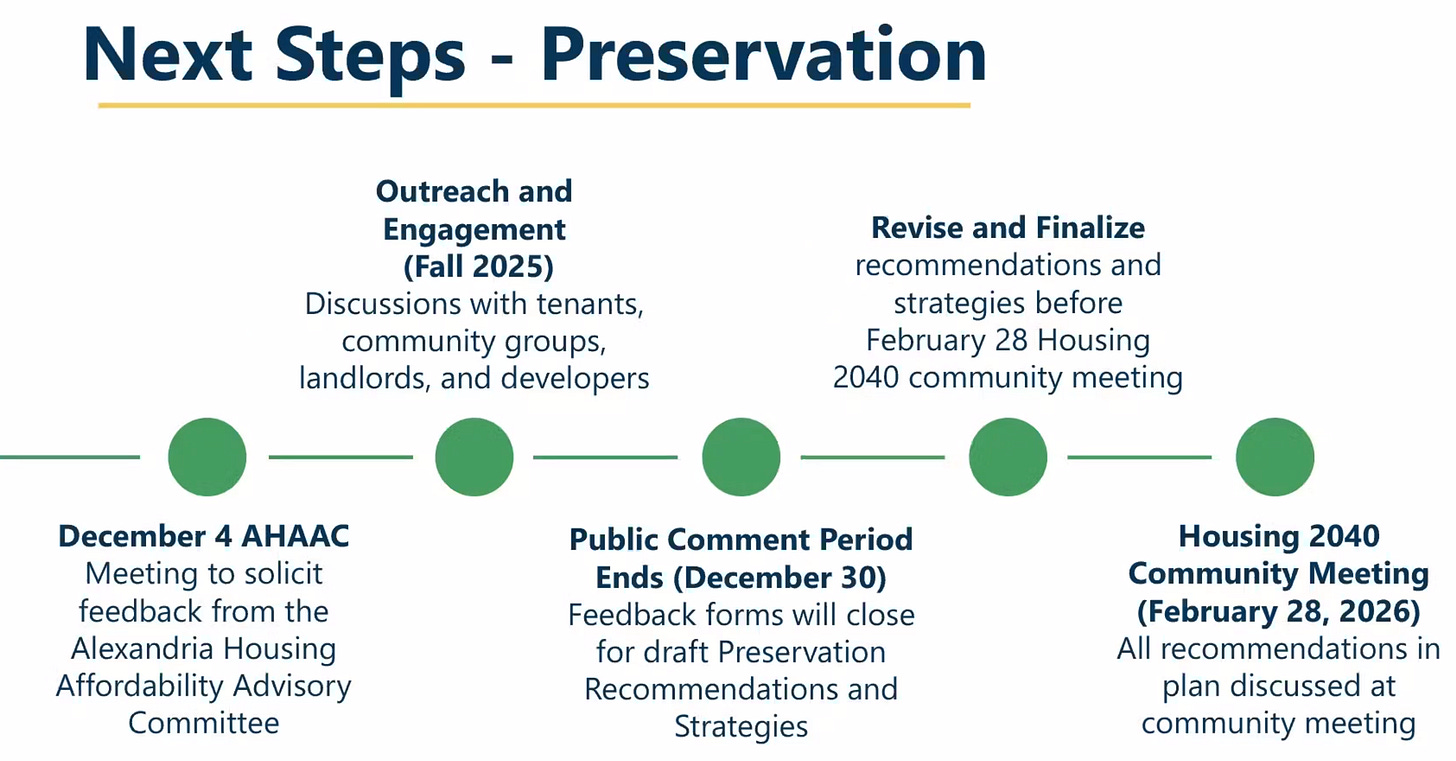

The public comment period on draft preservation and landlord-tenant recommendations remains open through December 30. The Alexandria Housing Affordability Advisory Committee reviews proposals on December 4 at 7 p.m. in City Hall.

The complete Housing 2040 plan will be presented on February 28, 2026, followed by public hearings in spring 2026. Implementation begins in the summer or fall of 2026.

As these proposals move forward, understanding the terminology, income levels, and types of affordable housing will be essential for residents evaluating which strategies to support and how the plan would affect their community.

Community members can provide feedback at alexandriava.gov/HousingPlan.